AI – A Game Changer for the Banking Industry

Are we in the Quantum Leap of Banking? Picture a world where numbers come alive, data dances to its rhythm, and Artificial Intelligence (AI) is the wizard behind the curtain. Brace yourself because the numbers don’t lie: AI is not just changing the game; it’s orchestrating a symphony of transformation in the banking realm. Get ready for a thrilling journey as we unveil the thrilling stats that prove AI is painting a brighter, bolder future for banking.

How AI affects global finance

In recent years, the banking industry has been undergoing a revolutionary transformation, and at the heart of this transformation is Artificial Intelligence (AI). AI’s attraction in the financial sector stems from its remarkable capacity to automate intricate processes, predict outcomes with exceptional precision, and comprehend intricate patterns beyond human capabilities. These capabilities have given rise to three prominent financial trends: Natural Language Processing (NLP), Machine learning, and the introduction of blockchain technology.

We have witnessed the emergence of Natural Language Processing (NLP), a subset of AI, which catalyzes enhancing customer interactions. NLP empowers AI to understand and generate human-like language, playing a pivotal role in automating customer services. The integration of AI-driven chatbots has streamlined customer interactions, providing personalized assistance and ensuring availability around the clock. This trend significantly reduces dependence on human agents, enhancing efficiency and substantial cost savings. Machine Learning (ML), another facet of AI, has demonstrated its prowess in fraud detection and credit assessment. ML algorithms analyze extensive datasets, meticulously sifting through complex patterns to detect potentially fraudulent activities and evaluate customers’ creditworthiness. These predictive capabilities not only mitigate risks but also contribute to eliminating biases in credit decisions by relying on factual data rather than subjective human judgments. Introducing blockchain technology has garnered global attention due to its potential to redefine the concept of transactions. By facilitating secure peer-to-peer transactions without intermediaries, blockchain technology has ushered in a new era of decentralized finance.

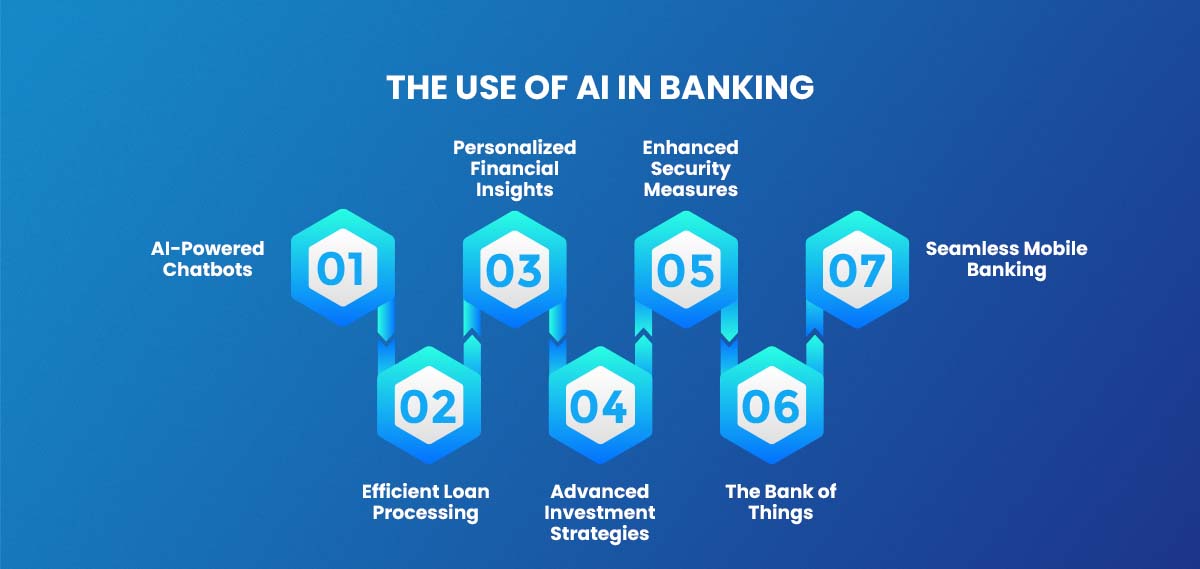

Understanding AI in Banking

1. The Rise of AI-powered chatbots

Customers expect instant solutions to their banking queries in today’s fast-paced world. AI-driven chatbots have provided real-time assistance, improving customer service while reducing operational costs.

2. Personalized Financial Insights

AI algorithms analyze vast amounts of customer data to offer personalized financial advice. This empowers customers to make informed decisions and deepens their trust in banking institutions.

Transforming Customer Experience

1. Enhanced Security Measures

AI bolsters security by identifying unusual patterns and potential threats in real time. This proactive approach ensures higher protection for both customers and banks.

2. Seamless Mobile Banking

Through AI, mobile banking apps offer intuitive features like voice commands and facial recognition, making banking smoother and more secure.

3. Smart banks with AI

Smart banks equipped with AI are at the forefront of the industry. AI analyzes vast datasets to provide insights into customer behavior, enabling banks to offer personalized services. It optimizes operations, streamlines customer interactions, and helps detect fraud, improving efficiency and customer satisfaction.

Revolutionizing Banking Operations

- Fraud Detection and Prevention

AI’s predictive analytics can identify fraudulent activities before they escalate, saving banks and customers millions while preserving trust.

- Efficient Loan Processing

AI streamlines loan application processes, reducing paperwork and approval times benefiting customers and banks.

AI and Decision-Making

- Data-Driven Insights

Banks use AI to analyze large datasets, helping them make strategic decisions that can shape the industry’s future.

- Risk Assessment

AI evaluates potential risks more accurately, enabling banks to develop robust risk management strategies.

Future Prospects of AI in Banking

- Advanced Investment Strategies

AI-driven algorithms can predict market trends, helping banks offer more profitable investment opportunities.

- Regulatory Compliance

AI assists banks in staying compliant with ever-evolving regulations, avoiding costly penalties.

The Age of Generative AI

- Generative AI

Generative AI revolutionizes customer engagement with its ability to create content autonomously. Banks can use it to personalize marketing materials, generate financial reports, and even draft customer communications. This saves time and resources and enhances the customer experience by delivering tailored content.

Conversational Banking

- Conversational Banking

Conversational banking, powered by AI-driven chatbots and virtual assistants, takes customer service to a new level. These intelligent systems provide real-time responses to customer inquiries, resolve issues, and offer product recommendations. It ensures 24/7 support, reduces response times, and enhances customer experience.

In-branch Banking Robots

- Banking Robots

In-branch robots are transforming the way customers engage with banks. They provide efficient guidance, answer frequently asked questions, and offer a unique customer experience. These robots free up human resources for more complex tasks and add a futuristic appeal to brick-and-mortar branches.

The Bank of Things

- IoT and Banking

Integrating IoT devices into banking services opens up a world of possibilities. Customers can link their smart devices to their bank accounts, enabling automated transactions, budget tracking, and real-time financial insights. This enhances convenience and allows banks to offer innovative services tailored to individual lifestyles.

Conclusion

In conclusion, AI is more than just a buzzword in the banking industry; it’s a game-changer. With its ability to enhance customer experiences, streamline operations, and aid decision-making, AI’s influence is undeniable. As we embrace this technological marvel, the banking industry will continue to evolve, offering more innovative and secure services to customers worldwide.

- Decoding Generative AI: A Comprehensive Guide to Gartner’s Impact Radar - January 2, 2024

- 5 Best Practices for Cloud Security in 2024 - December 29, 2023

- 10 Best Machine Learning Ops Strategies for Cloud Environments in 2024 - December 29, 2023