The Impacts of GST on Organisational IT

Impacts of GST on Organisational IT

GST, a unified tax structure, would be a game-changer in Indian financial structure. The implementation of Goods and Service Tax would call for many changes in IT framework (infrastructure) of an organization.

What is GST?

Goods and Services Tax seeks to abolish the large number of indirect taxes like Sales Tax, Central VAT, luxury Tax, Purchase Tax, Octroi, Excise Duty, and levy only a singular tax for the Goods and Services consumed. GST, a unified tax reform will help remove tax barriers or revenue collection challenges, between Centre and the States, creating a single unified market. According to the GST, goods and services are finalised to be divided into four tax slabs wiz. 5%, 12%, 18%, and 28%.

The Goods and Service Tax will comprise of:

- CGST: where the revenue will be collected by the Central Government

- SGST: where the revenue will be collected by the State Governments for intra-state sales

- IGST: which will be levied by Central Government on inter-State supply

GST and Technology

The Goods and Services Network (GSTN) will process about 3.5 billion invoices each month. IT industry experts doubt that the system can seamlessly match billions of credits, debits and check on tax evasion without any technical glitches. Harpreet Singh, partner, Indirect Tax at KPMG-India states that the rare case of non-functioning of the GSTN portal, due to technical issues could give sleepless nights to the industry and be a dark nightmare.

Applying security patches to dynamically generated sensitive data and updating accounting systems is a crucial step to ensure smooth transition to GST. Upgrading and proper training of information technology systems and taking other suitable measures also play a vital role for smooth shift towards GST.

Become a GST-Ready Organisation

GST is anticipated to be driven on online platform. A robust IT infrastructure is required where real time updation of data will take place. The massive amounts of sensitive financial data makes it inevitable to have a strong and stringent IT infrastructure, to meet reporting and security requirements. Also the GST-ready IT infrastructure should meet the compliance requirements as specified by GOI. Enterprise ERP systems need the very much essential revamp so as to add or deduct the rows where the information is fed-in, to keep things aligned asper new GST regime. IT teams require time-frames to update the ERPs and accounting softwares to realign with GST requirements. Trial and testing of the newly created or updated ERP systems becomes vital to check the functionality and avoid any last minute glitches. It may also require procurement of hardware for development and testing environments before moving to production environment a major tax reform rolls-out from 1 July,2017.

What will be few tweaks required to get GST Ready ERP?

Let us consider few pointers where you can get your ERP GST ready:

- The GST compliance of ERP systems is crucial as it impacts the functions of most of the departments at an organisational level. At the enterprise level, the ERPS must be planned, tested and implemented before the July 1 – GST deadline.

- The GST bill will definitely change the way businesses function now as all tax related procedures, documents will need to be aligned to GST rules

- When companies register and obtain a GST identification number (GSTIN), it will absorb the excise registration, service tax registration, and VAT registration

- Tax procedures will change completely to accommodate the new GST structure

- The transaction under new GST regime should be started afresh. The several pending or partially open transactions should be closed, reversed or migrated to the new GST system or need some temporary arrangements to be made.

- ERP companies like SAP have rolled-out GST related support and software patches. It is secure to have your GST implementation with SAP certified cloud service provider .

GST and SAP

GST is digital. The enterprises have to get rid of manual ledgers and vouchers, with deployment of strong technical backup aiding the shift towards digitization of all records and process automation in transactional systems. There is no alternate way than welcoming GST – compliant system.

SAP to act as an Application Service Provider (ASP) in Taxpayer enterprise landscape. SAP shall offer ASP services in the TaxPayer enterprise landscape through the SAP Localization Hub, Digital Compliance Service solution for India

SAP would be providing the required interfaces to upload the invoice in the GSTN. SAP will act an as Application Servce Provider(ASP) in GST landscape. GST registered business entities need to connect their enterprise SAP to GSTIN.

As stated earlier, business functions will undergo drastic changes, following the recommended procedures asper GST Model law. The changes made have to be reflected under the ERP suite too.

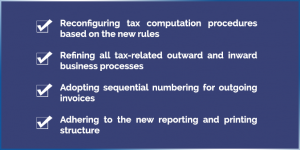

Some of the changes required in business processes would be:

The list of requirements specifically depends on the industry, complexity of business operations, legal entities involved in the business.

- The Impacts of GST on Organisational IT - June 23, 2017

- Cloud Technology becomes more intelligent with AI - June 5, 2017

- 5 Easy Hacks to prevent WannaCry Ransomware Attacks and keep your System Safe! - May 13, 2017