How the Insurance Industry Is Embracing Digital Transformation

The insurance industry is gaining benefits of digital transformation in several ways to mitigate the complex challenges that the industry faces from consumers, regulatory and digital landscapes. The leaders in this industry are looking to develop digital enterprise portals that can be built to meet future needs.

Benefits of DX to Insurance Companies

i. Easy Comparison

A key benefit of digitization for customers present in the insurance industry includes the availability of a self-service model. The customers today are defined as being present on “omnichannel”. The customers research the products online and then discuss with their closed ones using social media to gain some recommendations rather than going for buying through retail locations.

ii. Self-serviced Dashboards

The self-serviced dashboards have made it easier for the customers to decrypt the complicated insurance policies, calculate monthly premiums. These options are going to have a significant impact on the customer’s longer-term financial future and plans. The complicated coverage costs of the policies can now be virtually seen, thereby, helping the customers to understand the change rates and determining the best plans. Digitization also helps in making it easier for tracking the growing speed of their policies.

iii. Advanced Analytics

The insurance companies are using advanced analytics to gain insights on the needs and preferences of their customers. Advanced analytics also offer the insurance providers and customers to tackle fraudulent claims by building a superior system to detect the frauds by using big data analytics.

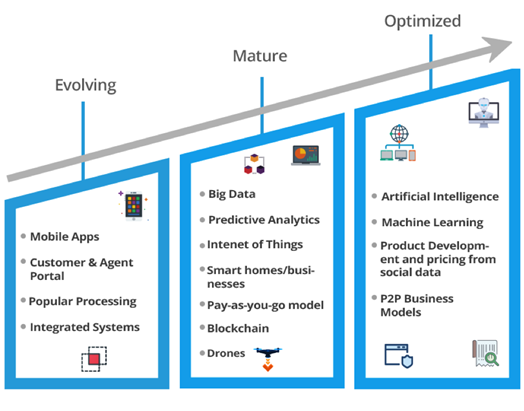

Phases of DX in Insurance

Insurance companies have begun their seamless transformation to the digital insurance providers with the help of a phased roadmap. They’re assessing their current situations, systems, and infrastructure for planning out which processes and part of businesses need to be moved to the digital landscape. This has proved to be of great help, as it helps the insurance firms in prioritizing the investments and thereby building digital workplaces built for future needs.

The phases in which digital transformation takes place in the insurance industry can be classified as-

1. Evolving:

Insurance firms have just begun to recognize the potential of digital transformation. They work on several initiatives for automating their processes and calibrating the business model to meet their business requirements.

2. Matured:

Insurance firms use advanced technologies and enterprise portal solutions for integrating emerging trends for rapid product development and launch.

3. Optimized:

The insurance firms are working towards futuristic solutions using newer technologies by analyzing integrated systems and innovative products that can transform the experience of the stakeholders.

Technological Trends in Insurance

i. Artificial Intelligence

Customers have always looked for personalized experiences when it comes to purchasing a P&C (property & casualty) insurance. Artificial Intelligence has been able to offer the insurer the ability to create unique experiences, thereby meeting the high-speed demands of modern-day consumers. By using AI, insurers can improve claims turnaround times and change the underwriting process. AI also enables the insurers to access the data fasters and minimize the human element, which could lead to more accurate reporting in shorter periods. The initial impact of AI will be related to improving efficiencies and automating the existing customer-facing underwriting and claims procedure. With time, its impact is going to be more profound as it will be able to identify, assess, and underwrite upcoming risks and identify new sources of revenue.

ii. Machine Learning

Machine learning will improve as well as automate claims processing. When files are stored in digital form and are accessible via the Cloud, they can be analyzed by using pre-programmed algorithms, thereby improving speed and accuracy. The automated review will impact not just claims, but can also be used for policy administration and risk assessment. The insurance companies can use machine learning-powered tools that can be used for consolidating insights from massive volumes of large-varied data. Machine learning can also be used for models like customer lifetime value (CLV) with the help of customer behaviour data for forecasting the retention and cross-buying as well as all critical factors present in the company’s future income. Machine Learning can also help insurers in predicting the likelihood of a particular customer’s behaviour.

iii. IoT

IoT can help in automating the data sharing done by the consumers to the insurance firms. Insurers can work on the data obtained from the Internet of Things devices like components of smart homes and wearable technologies for better-determining rates, mitigating these risks and preventing personal losses. IoT is also going to strengthen the insurance industry with first-hand data, thereby improving the accuracy of risk assessment, giving the insureds more authority to impact their policy pricing directly.

Challenges for Insurers in Embracing Digital Transformation

The insurance executives believe that technology might help them to improve their competitiveness and customer loyalty while cutting down on costs and boosting growth. In order to achieve a successful digital task, the insurers go through several hurdles before successfully implementing it.

Below are the top-5 digital transformation challenges that insurers face today-

1. Business Growth Through Customer Experience

Insurers are presumed to deliver omnichannel solutions across mobile, web, chatbots, and customer call centres for providing the customers with a seamless experience whenever and wherever needed. The agents and brokers have a significant role in the insurance industry, but most of the agent portals are going through poor customer experiences. For an insurance-like competitive market, the performance of agents and broker is crucial for acquiring newer customers and retaining the existing ones. The insurance executives hold a new mandate regarding the optimization of experiences of their teams. The top-priority agenda rests with an easy-to-use and user-friendly portal.

2. Pacing Up Time-to-Market and Beating Insurtech Competitors

Insurtech has disrupted the insurance business to a great extent. The advantages of data analysis and new technologies such as GPS car tracking or activity tracking present on the wearables has enabled the Insurtech to transform the market with more modern solutions and better customer experiences. Despite the slowing down of the startup activity in the industry, Insurtech still manages to drive the future of this industry. The most significant challenge that lies with traditional insurers is to map their experience with new ways for connecting customers, policyholders, agents as well as partners. The mix of insurers with customers needs to be done with speed, agility and the right time to market.

3. Delivering Seamless Experience Across Nations

Today, most of the insurance companies are operating across different countries. The companies need to ensure that they are providing a seamless experience across the states. Each country has got its own set of regulations, and the insurers need to adapt their policies and procedures that are compliant everywhere. The challenge for the insurance companies operating in multiple countries is the ability to customize and adjust their business and user experiences quickly to comply with different kinds of federal or state policies.

4. Ensuring a Connected Digital Ecosystem

With rising competition, many insurers are expanding their businesses and service offerings by plugging other companies in the existing ecosystem. A connected ecosystem can make the business processes complicated, and insurers need to connect all the different components of the ecosystem and ensure a smooth experience for customers, brokers, agents, and partners.

5. Maintaining Legacy Systems and Increasing Backlogs

Innovation is an essential component for insurers to remain competitive. Most of the matured insurance companies are still rely on their complex and disjointed legacy business systems. These consume both financial as well as human resources, thus, hampering the innovation process.

There has been a transformation

in the industry in terms of both- the approach used and the strategy formed.

The automation process of claims management, policy updates and compensation

have evolved significantly with advancements taking place in the field of

digitalization. This is certain that the insurance providers who’re going to

adopt early to the digital era will are going to have a competitive edge.

- Considering Data Centers in India to Overcome Economic Conditions - May 10, 2022

- Determining Why Your Organization Needs Web Application Security - February 11, 2022

- How Does a Business Benefit with Managed Services - January 21, 2022