Is Banking Heading Towards Digital Transformation in the Near Future?

Digital Banking is no more a talk of the future, and we all have witnessed the transformation of the Indian banking system. There was a time when visits to the banks were an essential part of our weekly schedules but it has almost become a phenomenon of the bygone era now. With most banking services available literally at our fingertips, digital banking has now become an inseparable part of our lifestyle. As just within the last decade the technological advancements like cloud computing in BFSI and many others, have brought about impeccable changes in the banking sector. From cards to digital payments, the digitization of the core banking services and not to forget the ground-breaking UPI payments mode, have become clearly synonymous with day-to-day business in the banking sector.

Looking towards the future prospect of the sector what we need to consider first is the present status of the daily operations in the banking sector.

The Present Status of Digital Banking in India

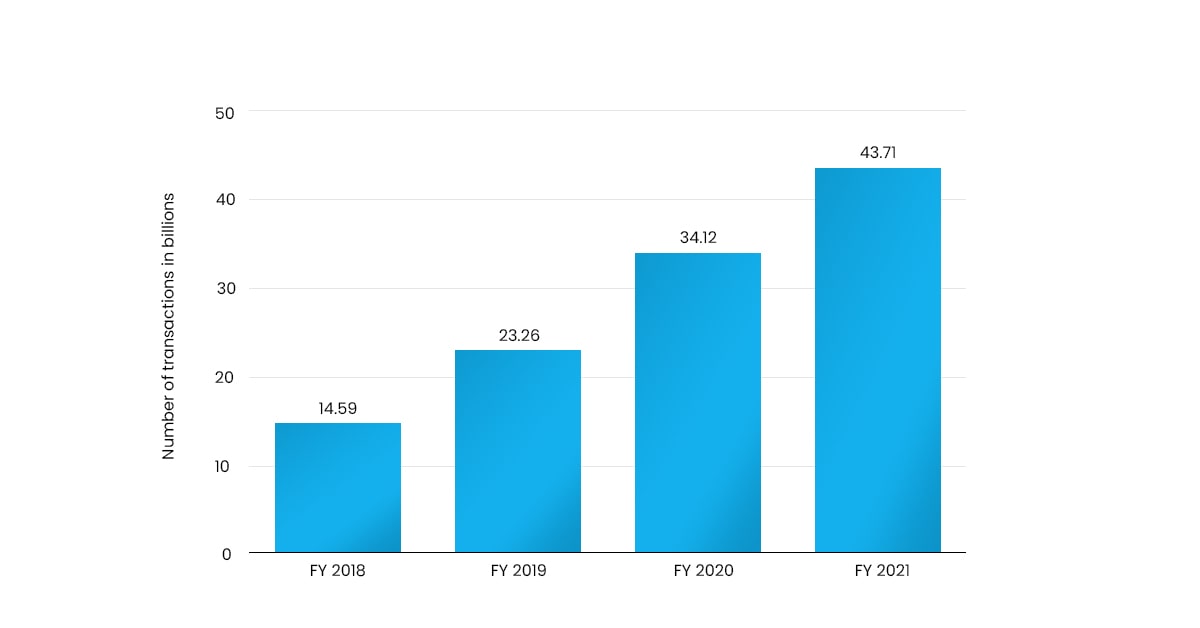

Talking about Digitization in the present day in Banking System, yes the sector has come a long way ahead of both in terms of the Core Banking System and various other administrative services in the daily business of the banking and finance organizations. Especially with the updates in the cloud banking solutions in India, banking administration has simplified and most importantly has brought about a remarkable change which has made the ease of doing banking business a thing of the present. Otherwise, who would have thought of real-time payments, easy or same-day loan procedures, or even a completely paperless Core Banking System? All becoming a common phenomenon in today’s banking system. Not just words but even numbers prove it with statistics from Statista about the “Total number of digital payments across India from the financial year 2018 to 2021” which clearly proves the exponential growth of digital payments in India, i.e. from USD 14.59Bn in FY 2018 to USD 43.71Bn in FY 2021.

All this has emphasized the Importance of Digital Transformation in Banking Sector, rather paved a way forward to look out for more in the same domain.

The Road Ahead: What more needs to be done?

Yes, there are many other things yet to be achieved when it comes to digital transformation in banking in India. With a humongous demographic diversity across the length and breadth of the country banking services are yet to be reached to every living corner and to do so, what the industry needs, is to draft a well-planned banking digital transformation road map in order to achieve a complete digital overhaul of the sector.

The next question that arises then is, what are the essentials to achieve the required transformation? Following are some of the key considerations while thinking of the complete digital transformation of the banking and overall financial sector.

Focusing on the Need of the Customers

From the customer’s perspective, the banking sector always needs to be on its toes in the literal sense. With the continuously rising demand and the fierce competition within the sector, each and every organization is going through a lot when it comes to delivering the best possible service to the customers. After all that a customer needs is every possible service at one click. On the other hand, even if we speak of it as a complete digital overhaul in banking there are some banking services like investments, insurances, and even financing for which a customer trusts a human but prefers technology for financial transactions. So the solution definitely has to be a perfect symphony of both.

Data-Based Approach

With technologies like IoT, Mobile applications, tap-based cards, blockchains all aligned with various cloud banking solutions results in the accumulation of ample data for banking and financial institutions. This can further be properly analyzed as per the transactional behavior of the customers to frame targeted strategies. This approach of influencing customer behavior through well-analyzed predictions based on consumer behavior data patterns will not only yield results but will definitely increase the engagement, attraction and build a sense of loyalty and trust amongst the customers.

Restructuring the System

As mentioned earlier when it comes to banking and financial business, customers prefer technology-based transactions but human advice for investment and other financial procedures. So, when it comes to planning to be future-ready, what needs to be done is create an experience of a perfect amalgamation of these two factors. For example, consider a large bank having several local branches in rural areas along with having a multi-channel digital connecting approach for the back-end work and process with proper cloud-based financial services.

To Sum it Up

Planning for and strategizing for a digital transformation in banking will just be the start point, it must be followed by proper and timely implementation. To achieve all these banks and financial institutions need to identify customer expectations based on which build a banking experience journey through a systematic operation model along with keenly observing competitors. As international banks and financial institutions are already providing smart banking solutions based on various cloud banking and cloud financial services. With cloud service providers like ESDS BFSI Community cloud is already providing banking-ready cloud-based smart banking solutions to 250+ banks and financial institutions.